Value for Money Insights - European Equity Funds

European equities have been gaining favour with investors in 2025 so far due to a combination of a strengthening currency, encouraging macroeconomic data and a supportive interest rate environment. Moreover, uncertainty over economic policies in the US and a need for diversification has led to improved flows into European equities.

For investors looking to gain or increase broad exposure to Europe, we analysed which European large cap equity funds provided Value for Money over the past three years.

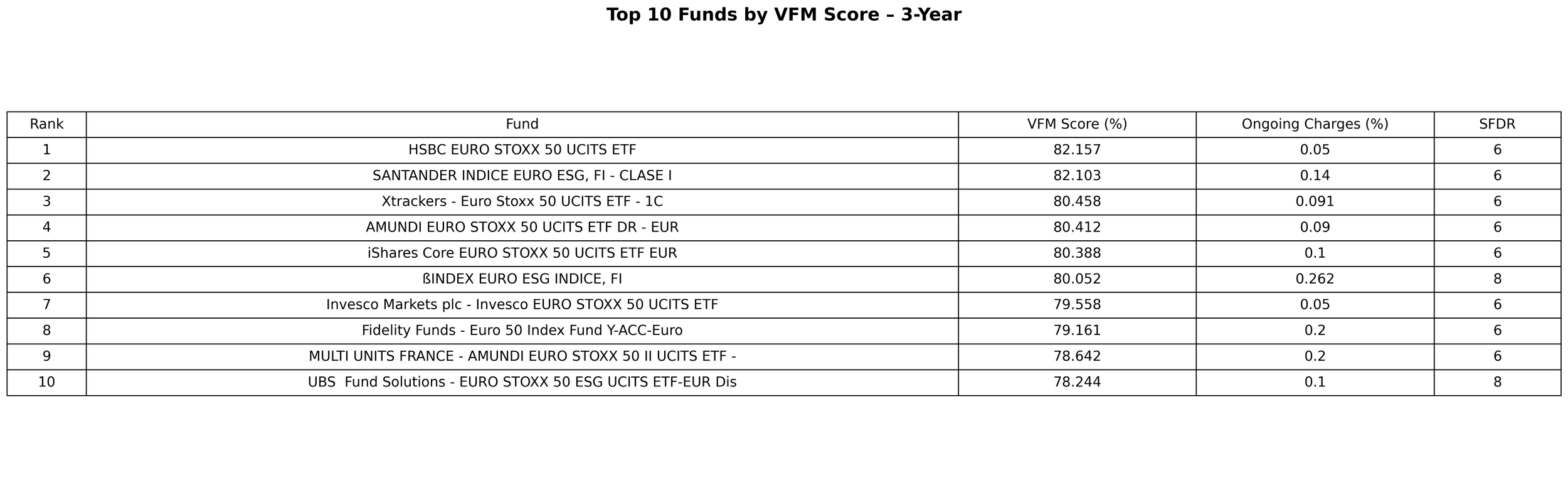

· Over the three-year period to 30 June 2025, the top-ranking value for money (VFM) funds are almost exclusively broad Eurozone equity index trackers.

· The relationship between fees and VFM is striking. The chart shows funds with higher ongoing charges almost invariably have lower VFM scores, while the highest VFM funds lie at the extreme low end of the cost range.

· The top ten funds by VFM charge well below 0.3% in annual fees, enabling strong net returns relative to cost (see table). These are predominantly ultra-low-cost index funds targeting Eurozone equities and have ongoing charges in the 0.05%–0.26% range.

· No fund with an ongoing charge above 0.26% made it into the top 10 VFM ranking. This illustrates how, over time, even small fee differences compound and can drag down value delivered to investors.

· Overall, the SFDR segmentation highlights a trade-off between sustainability focus and cost efficiency in the current fund landscape. Article 6 funds set a high bar for value due to rock-bottom fees. However, investors are generally faced with higher fees for Article 8 and 9 funds, which creates a headwind in the Value for Money analysis.